Shark Tank’s Kevin O’Leary, AKA “Mr. Wonderful,” Doesn’t Mince Words. Get Ready for Some Tough Medicine From a Top Shark. Afterall, what would a show called Shark Tank be without bite?

With his trademark wit and trenchant critiques, Kevin O’Leary is well-known for his unfiltered approach to business. Indeed, the show’s nine seasons are brimming with would-be entrepreneurs cut down by the man ironically dubbed “Mr. Wonderful.”

However, in our interview, O’Leary insists that he’s merely telling these up-and-comers exactly what they need to hear: the truth. “What is the point,” he asks, “of encouraging somebody to continue on a business plan to zero?”

It’s tough medicine from a professional who wasn’t born with a fast route to fortune. In fact, it’s possible that O’Leary’s harsh candor owes itself to the lessons of working his way up from a modest upbringing. The bedrock of his mission for “personal freedom,” he once claimed while speaking to Business Insider, was his termination at an ice cream shop while he was in high school.

It’s tough medicine from a professional who wasn’t born with a fast route to fortune. In fact, it’s possible that O’Leary’s harsh candor owes itself to the lessons of working his way up from a modest upbringing. The bedrock of his mission for “personal freedom,” he once claimed while speaking to Business Insider, was his termination at an ice cream shop while he was in high school.

“It was the end of the day of my second day of work, and the woman who owned the ice cream parlor said to me, ‘Listen, before you go, scrape all the gum up between the tiles,’” O’Leary said. Not wanting to be humiliated in front of his friends, he declined, arguing that the janitorial work was not in his job description. Naturally (but to his surprise at the time), he was fired. “I realized then that when you work for somebody else, you’re basically their slave,” he said, “From that day on, I swore I’d never work for anyone else. That was the beginning of my journey.”

And, after trial and error, doubts, and close calls with disaster, O’Leary eventually got his first taste of the Shark life. In the 90s, O’Leary took The Learning Company, something he started in a Toronto basement and transformed it into a multi-billion-dollar acquisition by Mattel. Ever since O’Leary has been involved in a variety of successful ventures and, with millions of Shark Tank viewers worldwide, “Mr. Wonderful” has become a household name.

Innovation & Tech Today: Do you think security is going to become even more important as our lives get more connected, for companies and individuals?

Kevin O’Leary: Definitely. There’s a lot of interest. You’ve got to remember that what Shark Tank is so good at now, going into its second decade, is we have tens of millions of eyeballs watching us every week. Not only in the U.S., but the tape is in other countries, so it’s become a global platform.

Kevin O’Leary: Definitely. There’s a lot of interest. You’ve got to remember that what Shark Tank is so good at now, going into its second decade, is we have tens of millions of eyeballs watching us every week. Not only in the U.S., but the tape is in other countries, so it’s become a global platform.

When we get a product that’s applicable to consumers, and, you’re right, security, biometrics technology, all of that is very, very interesting to our viewers. When we find products like BenjiLock, which are very easy to understand … Everybody gets why this product is useful, and how it works. Everybody has a situation where they forgot a combination or they lost a key. It’s so perfectly simple and yet uses technology that’s so applicable to today. The idea that you can store multiple fingerprints, and that it tests for how many times people try and open it that way – all of that is so great that we think it’s going to be a monster hit. A monster. That’s why we think we want to support him, and we’ve begun the journey. We have multiple lock companies interested in the technology, and that’s what I bring to the table. This is what I’ve done my whole life. This is exactly a perfect fit for me, Mr. Wonderful.

I&T Today: We’ve spoken with Daymond Johnn and Robert Herjavec. It seems like you guys really do get along off camera, and you guys really are a family. Would you agree with that?

Kevin O’Leary: I would. Think about Barbara [Corcoran], for example. I’ve known her for 10 years. The only reason she gets anywhere on time these days is I bought her a new broom. She loves that joke, by the way.

I&T Today: Speaking of which, do you relish your role as being kind of the lovable meanie on the show?

I&T Today: Speaking of which, do you relish your role as being kind of the lovable meanie on the show?

Kevin O’Leary: You know, I’m not mean. I just tell the truth. The one thing that differentiates me, versus the other Sharks, is they just don’t have the guts to tell these people the truth. What is the point of encouraging somebody to continue on a business plan to zero? I’m telling the truth. Nothing mean about that.

I&T Today: Getting a participation trophy doesn’t fly in the business world, does it?

Kevin O’Leary: No. Business is binary. Either you make money or you lose it. You think I’m tough in Shark Tank, wait ‘til the real world gets a hold of you. It’ll chew you to pieces. I think it’s a great thing to get in front of investors like in Shark Tank, who should be at arm’s length and unbiased, so they’ll tell you the truth. But I think there’s a lot of concern about people’s feelings. Screw all that! This is about business. I’m not trying to make friends. I’m trying to make money. If I want friends, or if you want another friend, buy a dog.

I&T Today: What process do you use to get through the hype and determine if an idea can be a business?

Kevin O’Leary: Well, I like to use anecdotal data because I’ve got a whole team that does due diligence, obviously, when I have to, because we look at so many different deals all the time. But I like to actually use the product myself. I love to invest in products or services that I actually pay for and use myself.

So if I’ve got a product that looks interesting – like BenjiLock, for example – I’m going to buy BenjiLock for my lake house, and many of my other homes because I have that problem. I have lost the key for the lock on my boathouse garage. Well, that’s a real pain in the butt, and I wish I had the ability just to use a fingerprint to open it up. I mean, even if it’s been sitting there for two years, and you can charge the battery up and push your finger on it again. Bingo! That saves so much of a headache, and I think it’s so brilliant.

Now that kind of a thing is easy for me to make a decision on, because I know I would use it. It doesn’t mean it’s going be a great investment but in the case of something that solves a problem globally. I mean, padlocks are used from Cambodia to Cameroon to the United States to Ethiopia to Cypress. They’re used everywhere. We don’t see that too often on Shark Tank – where we can take a product and blow it up globally.

I&T Today: This seems to be a really exciting time. You’ve been around business for a long time, and you’ve seen a lot of booms and busts. How would you describe this climate?

Kevin O’Leary: Well, there’s lots and lots of great ideas. There’s no question technology is completely disrupting many different industries. You can see it in retail all across America, for example. What we’re missing a lot of is executional skills. Shark Tank really highlights something that’s important for entrepreneurs to understand.

Kevin O’Leary: Well, there’s lots and lots of great ideas. There’s no question technology is completely disrupting many different industries. You can see it in retail all across America, for example. What we’re missing a lot of is executional skills. Shark Tank really highlights something that’s important for entrepreneurs to understand.

There’s three elements to a deal. Number one is a great idea. And then there’s the concept of executional skills – to actually execute the deal itself. Just because you have a great idea doesn’t mean you’re going to be successful. Much harder is to execute on the vision and being able to pivot when things don’t work out. We really struggle with that, even on Shark Tank. I have great ideas with weak entrepreneurs, and I have to make changes in their companies over time. Then I’ve got incredible entrepreneurs that come out with ideas that I think are mediocre, that end up being very successful because they have such amazing entrepreneurial or executional skills. So, it’s kind of a combination of both.

What we need more in America – and any country would – but definitely we’ve got great ideas, but we need more great entrepreneurs with executional skills. Because you can start to see after a couple of years on a great idea, if the people that are driving it don’t know what they’re doing, it’s not successful.

I&T Today: Do you think there’s a little bit more accountability, as far as investing in these tech ideas and these companies that aren’t turning a profit goes?

Kevin O’Leary: There’s always risk in investing in a company that has no profit, and can’t distribute any capital back to shareholders. Because the only way you can profit on companies like that is on the momentum that others want to own the stock at a higher price, even though there’s no profit supporting it. So, what happens is when that story deflates, or when investors have a different sentiment about it, you can have major corrections. It doesn’t mean they’re not good companies, or the products are bad. It just means there’s a very speculative nature to that purchase. I prefer to be an investor, not a speculator, so I generally value companies on cash flow.

Kevin O’Leary: There’s always risk in investing in a company that has no profit, and can’t distribute any capital back to shareholders. Because the only way you can profit on companies like that is on the momentum that others want to own the stock at a higher price, even though there’s no profit supporting it. So, what happens is when that story deflates, or when investors have a different sentiment about it, you can have major corrections. It doesn’t mean they’re not good companies, or the products are bad. It just means there’s a very speculative nature to that purchase. I prefer to be an investor, not a speculator, so I generally value companies on cash flow.

I’ve learned over a long period of time, cash flow is what people actually want to invest in – not speculation. There’s a period when speculation works, and then all of a sudden it doesn’t. Then you’re down 38 percent the next day. That’s a negative aspect to that.

I&T Today: It’s kind of like that other shoe that drops whenever you’re the one on Shark Tank who says, “So … tell me about your sales.”

Kevin O’Leary: Right. Well, you know, I’m the guy that asks them about valuation a lot because I love the exuberance of a great idea. And somebody says, “Well, this idea’s worth $10 million, and I haven’t sold anything yet.” Well, I know with certainty that reality will strike; gravity will strike. I don’t tend to invest in that kind of a situation. I want … I love companies that come on Shark Tank that have revenue and profits. Then I know that I can take my money, regardless of how much it is, and pour it on the business model and expand that dramatically. That’s what’s so interesting. Once in a while, I’ll take a flier, and I do. But if you look at the companies that I invest in, they tend to be more conservative in nature, and they’re running real businesses. I like that.

I&T Today: What’s the best advice you would give a person who thinks they have a great idea, and they want to blow it up?

Kevin O’Leary: Be an apprentice for two years. Take a sector you like and go work in it and prove to the people there that run a real business that you’re a great value to them. This is something that Europeans do very well. Many people in Switzerland, for example … And I’m well aware of how that country works. They leave college, and they work for two years as an apprentice. If they like the biotech sector, they go there. If they like the pharma sector, they go there.

What I’ve learned in life is that great entrepreneurs understand the value equation. In other words, if you’re very good at what you do, and you can add value to a business, you become, yourself, a primary asset. The reason that’s important is when you go out there to raise your own money, and you have a bit of a track record as a successful element of a company that’s made in the sector you’re interested in. In other words, you’ve worked for somebody in a sector that you’re now asking to break out in and get funded for. That’s very interesting for me as an investor. I like to see executional skills. I said that earlier. Executional skills are what I invest in. And because great entrepreneurs with executional skills know how to pivot, they know how to solve problems, they know how to do things to keep their dream alive. I love to invest in people like that.

I&T Today: Are you always on your phone? Or are you pretty good at segmenting, or breaking away from the business side of things, when you need to take some time away?

Kevin O’Leary: Well, I talked about the value of success in entrepreneurship is it provides for personal freedom. So the rule I have in my family is, on the weekends we always gather together. I can afford to do that. Last week it was in Paris. The week before that, Geneva. This weekend, it’ll be New York. I’ll bring my kids to be with me, and the rest of my family. We try and get together as often as we can. I try and shut down for those two days.

I do get up pretty early in the morning because I’m a chairman of O’Shares. We’re a global investor. We run ETFs on the New York Stock Exchange, and we invest all around the world. I like to look at the European and Asian markets, so I get up pretty early. About five o’clock, and I do it from a bike. I ride for an hour, and try and burn off 600 calories. Do my stretches. Get caught up with the market. I got a routine that I really enjoy, and that quiet time in the morning … probably between 5:00 and 7:30 am is when I get 90 percent of my work done because then the phone starts ringing. Crazy stuff happens, and I do the TV stuff. But, in that early morning, I just love to be in my office and do my thing. Just watching the world go through with emails, and all my trading screens, and everything else. I think it’s very interesting.

I do get up pretty early in the morning because I’m a chairman of O’Shares. We’re a global investor. We run ETFs on the New York Stock Exchange, and we invest all around the world. I like to look at the European and Asian markets, so I get up pretty early. About five o’clock, and I do it from a bike. I ride for an hour, and try and burn off 600 calories. Do my stretches. Get caught up with the market. I got a routine that I really enjoy, and that quiet time in the morning … probably between 5:00 and 7:30 am is when I get 90 percent of my work done because then the phone starts ringing. Crazy stuff happens, and I do the TV stuff. But, in that early morning, I just love to be in my office and do my thing. Just watching the world go through with emails, and all my trading screens, and everything else. I think it’s very interesting.

I&T Today: You kind of get in that genius mode, huh?

Kevin O’Leary: You know, I think there’s a lot to be said about personal productivity. What I do – and I teach this too now – I write on just a yellow sticker three things I’ve got to get done before I accept a phone call or write an email. It’s just three things that are going to happen. You can’t believe how productive you get when you’ve just put your top three things … Could be anything. When you get those done before you do anything else, you become extremely productive. I learned that from one of my women CEOs. It’s rather remarkable in Shark Tank history, the majority of my returns have come from the companies run or owned by women. I’ve learned a lot from working with them because they tend to be extremely good at managing time. There’s that old adage, “If you want something done, give it to a busy mother.” But they also set goals that are achievable. They have lower staff turnover. They have higher IRRs for me. So I’ve really started to try and institutionalize some of their philosophies into all of my businesses.

Kevin O’Leary: You know, I think there’s a lot to be said about personal productivity. What I do – and I teach this too now – I write on just a yellow sticker three things I’ve got to get done before I accept a phone call or write an email. It’s just three things that are going to happen. You can’t believe how productive you get when you’ve just put your top three things … Could be anything. When you get those done before you do anything else, you become extremely productive. I learned that from one of my women CEOs. It’s rather remarkable in Shark Tank history, the majority of my returns have come from the companies run or owned by women. I’ve learned a lot from working with them because they tend to be extremely good at managing time. There’s that old adage, “If you want something done, give it to a busy mother.” But they also set goals that are achievable. They have lower staff turnover. They have higher IRRs for me. So I’ve really started to try and institutionalize some of their philosophies into all of my businesses.

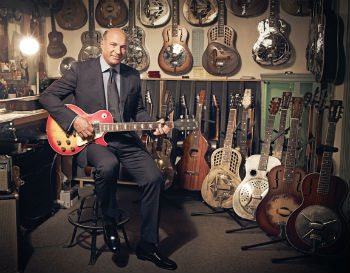

Images Courtesy of Kevin O’Leary