A group of researchers seeking data have assisted 10,000 different companies, which are backed by some of the world’s largest investment firms. What are they assisting with? Navigating and understanding businesses’ climate change plans.

TPI’s Goals

The Transition Pathway Initiative and London School of Economics are teaming up to open the TPI Global Transition Centre that will publish the findings of the assessments. The research center will be located at the London School of Economics.

TPI will expand its work through the initiative that compares companies on their own environmental performances. TPI is currently giving scores to approximately 400 companies on their climate change management skills.

Team Effort

The group is supported by over 100 large investment firms managing a total of $40 trillion in assets. A few of the world’s largest money management firms on TPI current backer list are BlackRock Inc., abrdn PLC, BNP Paribas Asset Management, and Legal & General Investment Management.

“There’s a whole variety of ways companies set net-zero targets and commitments and it’s very hard to assess those in a consistent way” said David Harris, head of sustainable finance products at London Stock Exchange Group PLC, who also works with TPI.

Transparency is Key

Investors constructing portfolios are the target of TPI’s assessments, but TPI stated that the assessments are also freely available to the public. Mr. Harris also said that making the data public will build momentum among investors and help companies understand how they are being reviewed.

“In order for companies to improve their assessments, it’s really important that you have a very high level of transparency,” he added.

How the Assessments Work

A couple of non-profit groups such as Data-Driven Envirolab and the NewClimate Institute have said that more than 1,500 companies have plans to reach net-zero on emissions, but that approach will vary among companies — and their industries. Scope 3, or greenhouse emissions, may prove to be some companies’ biggest struggles to get to net-zero. It is the biggest portion of a company’s emissions and is not always taken into account.

TPI’s solution to this is that in their assessments to the company they with conduct an appraisal in two parts: a review of the company’s “management quality” and its “carbon performance” with hopes of helping each company reach net-zero on emissions.

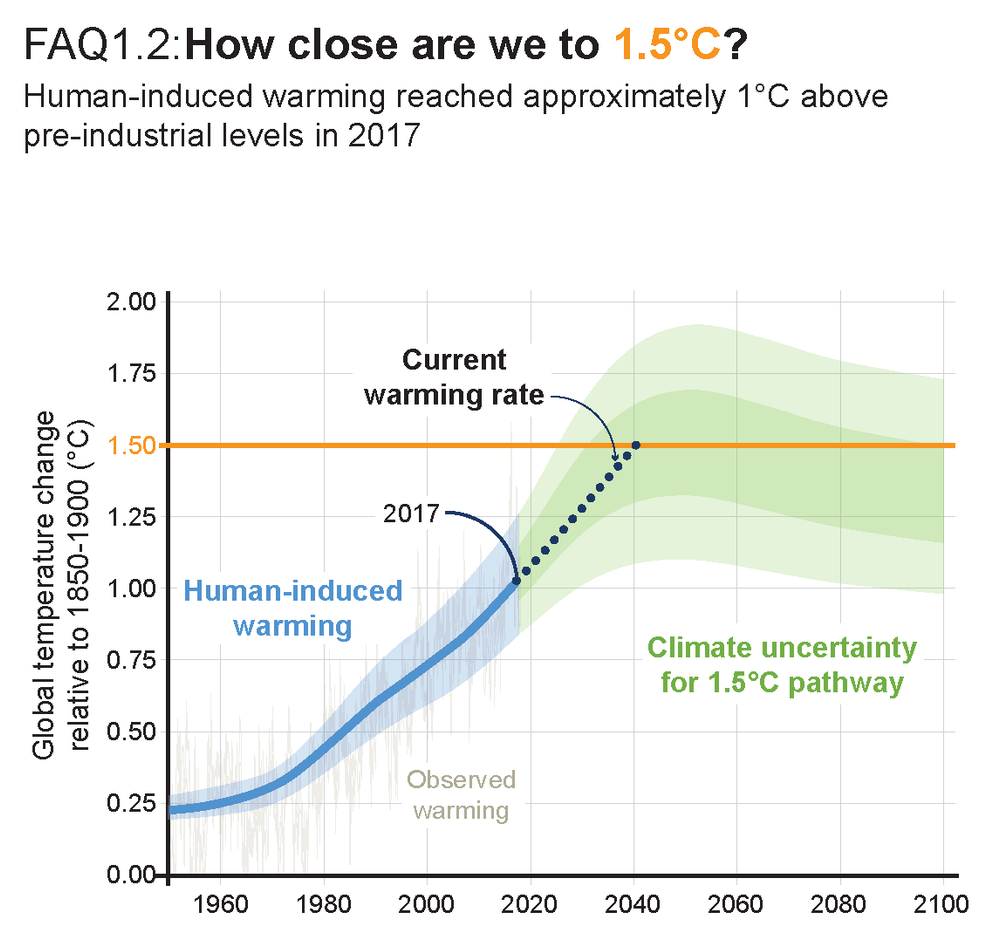

Companies are scored in “management-quality” on a 19-question survey that grades on a scale of 0 to 4. This includes whether the company has a committee or board member managing the climate change policy; and if each company records and reports Scope 3 emissions. Companies are also scored in “carbon-performance”, which compares the company’s emission progress to the industry in which it is related. The survey also tests a company’s current and future target goals to stay within reach of the Paris Agreement that aims to reduce the earth’s warming by the end of the 2000s.

TPI’s current source of information and data comes from websites, disclosures, and annual reports, which are all available to the public in the not-for-profit environmental reporting platform CDP. TPI’s current stock-index operator is FTSE Russell, part of the London Stock Exchange Group which provides the data for the management-quality assessments. FTSE Russell already uses TPI’s climate change data in its assessment.