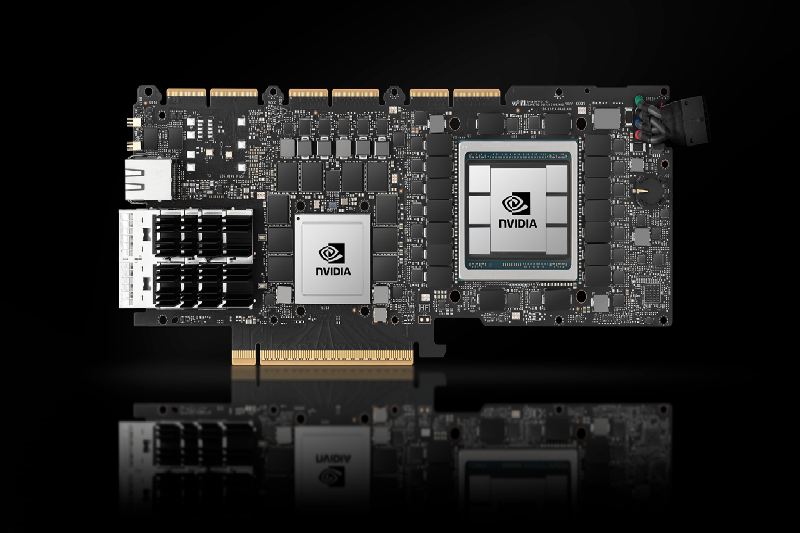

Nvidia Corp (NVDA) has been on a tear lately, surging to a record high of $389.46 on Friday, up 30% from Wednesday’s close. The chipmaker’s stellar earnings report and guidance, driven by strong demand for its artificial intelligence (AI) products, has stunned investors and analysts alike.

Nvidia’s revenue for the first quarter of fiscal 2024 was $7.01 billion, up 84% year-over-year and beating expectations by $530 million. Its earnings per share was $3.66, up 106% year-over-year and smashing estimates by $0.88.

But what really impressed the market was Nvidia’s outlook for the second quarter, which projected revenue of $8.25 billion, well above the consensus of $6.51 billion. The company said it expects strong growth across all its segments, especially its data center business, which provides chips for AI applications such as cloud computing, natural language processing and computer vision.

Nvidia’s CEO Jensen Huang said the company is “in the early stages of an AI-led computing revolution that will transform every industry.” He added that Nvidia is “creating the computing platform that will enable this transformation.”

Nvidia’s massive AI-fueled rally has helped power the stock market above a key resistance level that suggests more upside ahead, according to Fairlead Strategies’ founder Katie Stockton. She said the S&P 500 needs to close above 4,155 on Friday to confirm a bullish breakout, which would imply potential upside of 8% to 4,510.

In case you missed it

But Nvidia is not the only stock that stands to benefit from the AI boom. Investors who missed out on Nvidia’s rally may want to look at some related stocks that could also ride the wave of AI innovation.

One such stock is Advanced Micro Devices (AMD), Nvidia’s main rival in the graphics processing unit (GPU) market. AMD has also been growing its data center business with its Radeon Instinct GPUs, which compete with Nvidia’s Tesla GPUs. AMD reported revenue of $3.45 billion for the first quarter of 2023, up 93% year-over-year and beating expectations by $120 million. Its earnings per share was $0.52, up 189% year-over-year and topping estimates by $0.08.

Another stock to watch is Xilinx (XLNX), which makes programmable chips called field-programmable gate arrays (FPGAs) that can be customized for different AI tasks. Xilinx is being acquired by AMD for $35 billion in an all-stock deal that is expected to close by the end of 2023. Xilinx reported revenue of $851 million for the first quarter of fiscal 2024, up 13% year-over-year and beating expectations by $31 million. Its earnings per share was $0.82, up 16% year-over-year and exceeding estimates by $0.12.

A third stock to consider is Intel (INTC), which is trying to regain its footing in the chip industry after losing ground to Nvidia and AMD. Intel has been investing heavily in its AI capabilities, such as its Habana Labs acquisition and its Nervana Neural Network Processor (NNP) line. Intel reported revenue of $19.7 billion for the first quarter of 2023, down 1% year-over-year but beating expectations by $1 billion. Its earnings per share was $1.39, up 6% year-over-year and surpassing estimates by $0.29.

These are just some of the stocks expected to benefit from the AI revolution that Nvidia is leading. As Nvidia’s Huang said, “AI is the most powerful technology force of our time.”