For the past year, Americans for Tax Fairness (ATF) and the Institute for Policy Studies (IPS) have tracked the wealth growth of America’s billionaires since March 18, 2020, the rough beginning of the pandemic. This report summarizes the extraordinary growth in wealth of those now 657 billionaires based on real-time data from Forbes on March 18, 2021.

Here are highlights from the last 12 months of billionaire wealth growth:

- The combined wealth of the nation’s 657 billionaires increased more than $1.3 trillion, or 44.6%, since the pandemic lockdowns began. [Master Table] Over those same 12 months, more than 29 million Americans contracted the virus and more than 535,000 died from it. As billionaire wealth soared over, almost 80 million lost work between March 21, 2020, and Feb. 20, 2021, and 18 million were collecting unemployment on Feb. 27, 2021.

- There are 43 newly minted billionaires since the beginning of the pandemic, when there were 614. A number of new billionaires joined the list after initial public offerings (IPOs) of stock in companies such as Airbnb, DoorDash, and Snowflake.

- The increase in the combined wealth of the 15 billionaires with the greatest growth in absolute wealth was $563 billion or 82%. [Table 1] The wealth growth of just these 15 represents over 40% of the wealth growth among all billionaires. Topping the list are Elon Musk ($137.5 billion richer, 559%), Jeff Bezos ($65 billion, 58%) and Mark Zuckerberg ($47 billion, 86%).

- The 10 biggest “Pandemic Profiteers” saw the greatest percentage increase in their wealth—at least 300%. [Table 2] They mostly multiplied their fortunes in the world of online goods, services and entertainment, as forcibly homebound Americans shopped, invested and diverted themselves in isolation. They include the owners of ecommerce leaders Quicken Loans, Square, Carvana, and cryptocurrency exchange Coinbase; social media sites Snapchat and Twitter; online streaming platform Roku; and digital ad agency Trade Desk. 19 other billionaires experienced increases of over 200% while 48 others more than doubled their fortunes with 100%+ gains.

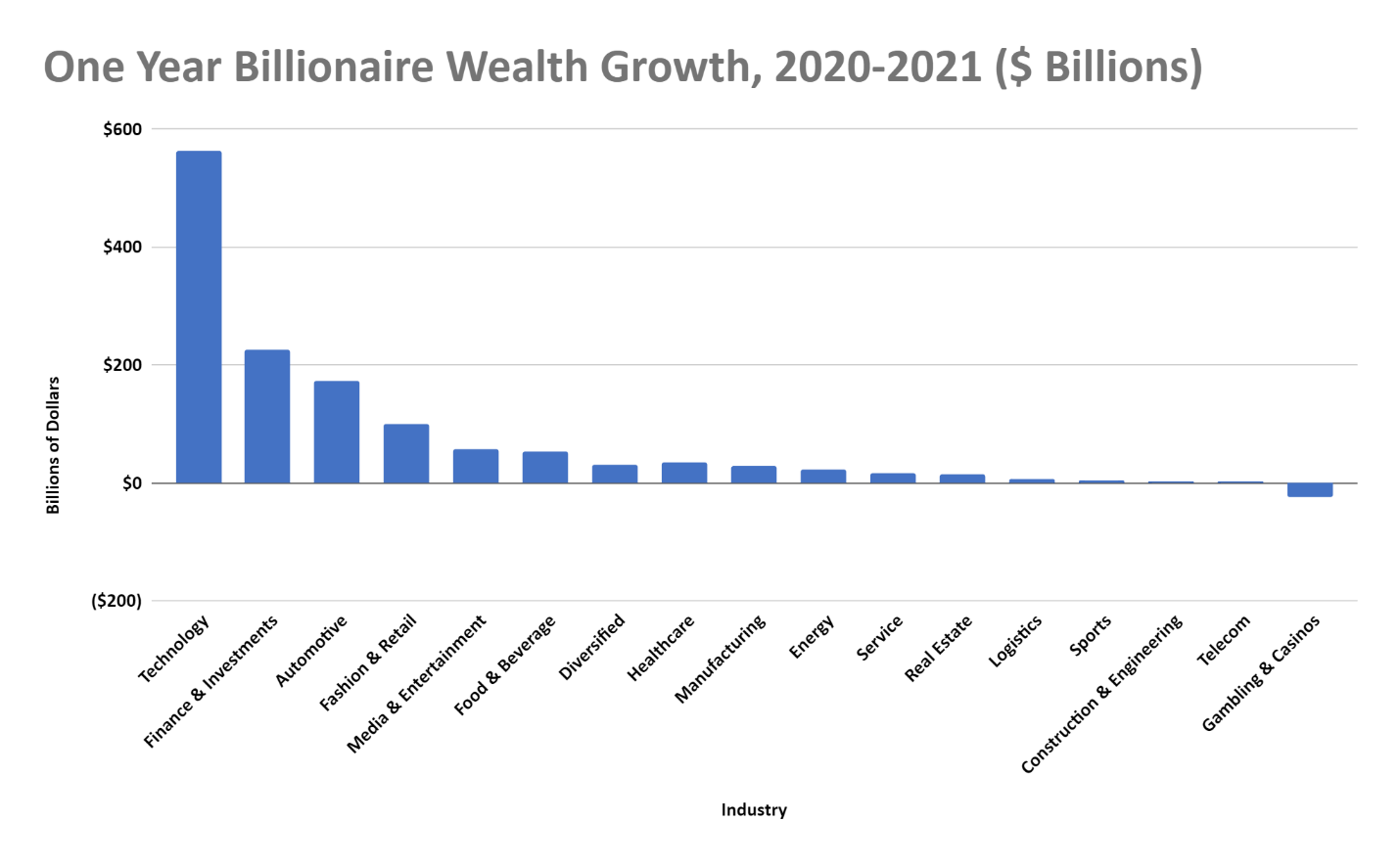

- Of 17 industry categories, billionaires in the technology industry had the greatest collective wealth growth—$564 billion, or nearly 68%. [Table 3] They were worth $1.4 trillion on March 18, 2021, or one-third of the billionaires’ total. The titans of Wall Street—the Finance & Investment industries—saw their wealth grow by $226 billion—a nearly 37% increase. Automotive industry billionaires had the biggest percentage point increase in wealth—317% based on an increase in wealth of $172 billion. That was largely driven by the extraordinary rise in Elon Musk’s wealth—$137.5 billion or 559%.

- All but three states saw the wealth of their billionaire residents increase. [Table 4] Topping the list in total wealth growth are California at $551 billion, Washington at $134.6 billion, and New York at $116.4 billion. The top three states with the greatest percentage increase in wealth are Michigan at 164%, Arizona at 110%, and Hawaii at 107%.

Billionaire wealth growth is calculated between March 18, 2020 and March 18, 2021, based on Forbes data compiled in this report by ATF and IPS. March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

“The pandemic has created an astonishing rise in wealth for the nation’s billionaires while tens of millions of Americans fell further behind,” said Frank Clemente, executive director of Americans for Tax Fairness. “Billionaires are living in a different world from the rest of us. It’s time we bring them down to earth and make them pay their fair share of taxes like the rest of us so we can create an economy that works for everyone.”

“The pandemic profiteers are extracting windfalls of wealth during a time of widespread suffering for the majority of people,” said Chuck Collins, director of the Institute for Policy Studies’ Program on Inequality. “They exploit the artificial markets created by the pandemic, including having their Main Street competition shuttered and our increased dependence on online technologies.”

Under current tax law, none of the billionaires’ wealth will be taxed during their lifetimes, unless the underlying assets are sold at a gain. Thanks to a weakened estate tax and aggressive estate-tax dodging by the rich, much of the money will also escape taxation when passed onto the next generation.

Sen. Elizabeth Warren and colleagues in the House have introduced the “Ultra-Millionaire Tax Act” to reap some revenue from huge fortunes that otherwise sit untaxed year after year. The tax rate would just be two cents on the dollar (2%) for people with wealth between $50 million and $1 billion and just three cents on the dollar (a total of 3%) for wealth above $1 billion. According to an ATF and IPS analysis of Forbes data, America’s billionaires alone would owe $114 billion for last year if Warren’s wealth tax had been in place and $1.4 trillion over 10 years. The law would raise a total of about $3 trillion over 10 years.

TABLE 1

| U.S. BILLIONAIRES WITH THE GREATEST TOTAL WEALTH GROWTH IN ONE YEAR March 18, 2020 – March 18, 2021 | ||||||

| Name | Net Worth Mar. 18, 2020 ($ Billions) | Real Time Worth Mar. 18, 2021 ($ Billions) | Wealth Growth Mar. 18, 2020 –Mar. 18, 2021 ($ Billions) | % Wealth Growth Mar. 18, 2020 –Mar. 18, 2021 | Primary Source | State |

| Elon Musk | $24.6 | $162.1 | $137.5 | 558.9% | Tesla, SpaceX | California |

| Jeff Bezos | $113.0 | $178.1 | $65.1 | 57.6% | Amazon | Washington |

| Mark Zuckerberg | $54.7 | $101.7 | $47.0 | 85.9% | California | |

| Daniel Gilbert | $6.5 | $48.2 | $41.7 | 641.5% | Quicken Loans | Michigan |

| Larry Page | $50.9 | $88.6 | $37.7 | 74.1% | California | |

| Sergey Brin | $49.1 | $86.0 | $36.9 | 75.2% | California | |

| Larry Ellison | $59.0 | $90.2 | $31.2 | 52.9% | Oracle | California |

| Warren Buffett | $67.5 | $96.5 | $29.0 | 43.0% | Berkshire Hathaway | Nebraska |

| Bill Gates | $98.0 | $126.5 | $28.5 | 29.1% | Microsoft | Washington |

| Phil Knight | $29.5 | $52.9 | $23.4 | 79.3% | Nike | Oregon |

| Michael Dell | $22.9 | $46.2 | $23.3 | 101.7% | Dell computers | Texas |

| MacKenzie Scott | $36.0 | $53.5 | $17.5 | 48.6% | Amazon | Washington |

| Steve Ballmer | $52.7 | $68.4 | $15.7 | 29.8% | Microsoft | Washington |

| Len Blavatnik | $17.0 | $31.7 | $14.7 | 86.5% | diversified | |

| Ernest Garcia, II. | $2.4 | $16.0 | $13.6 | 566.7% | used cars | Arizona |

| SUBTOTAL | $683.8 | $1,246.6 | $562.8 | 82.3% | ||

| ALL OTHERS | $2,263.7 | $3,016.9 | $753.2 | 33.3% | ||

| TOTAL | $2,947.5 | $4,263.5 | $1,316.0 | 44.6% |

Source: Forbes data analyzed by Americans for Tax Fairness and Institute for Policy Studies, March 18, 2021

TABLE 2

| U.S. BILLIONAIRES WITH THE GREATEST PERCENT OF WEALTH GROWTH IN ONE YEARMarch 18, 2020 – March 18, 2021 | ||||||

| Name | Net Worth Mar. 18, 2020 ($ Billions) | Real Time Worth Mar. 18, 2021 ($ Billions) | Wealth Growth Mar. 18, 2020 – Mar. 18, 2021 ($ Billions) | % Wealth Growth Mar. 18, 2020 – Mar. 18, 2021 | Primary Source | State |

| Bom Kim | $1.0 | $7.7 | $6.7 | 670.0% | online retailing | |

| Daniel Gilbert | $6.5 | $48.2 | $41.7 | 641.5% | Quicken Loans | Michigan |

| Ernest Garcia, II. | $2.4 | $16.0 | $13.6 | 566.7% | used cars | Arizona |

| Elon Musk | $24.6 | $162.1 | $137.5 | 558.9% | Tesla, SpaceX | California |

| Brian Armstrong | $1.0 | $6.5 | $5.5 | 550.0% | cryptocurrency | California |

| Bobby Murphy | $1.9 | $12.0 | $10.1 | 531.6% | Snapchat | California |

| Evan Spiegel | $1.9 | $11.2 | $9.3 | 489.5% | Snapchat | California |

| Jack Dorsey | $2.6 | $12.9 | $10.3 | 396.2% | Twitter, Square | California |

| Anthony Wood | $1.6 | $6.9 | $5.3 | 331.3% | Roku | California |

| Jeff Green | $1.0 | $4.0 | $3.0 | 300.0% | digital advertising | California |

| SUBTOTAL | $44.5 | $287.5 | $243.0 | 546.1% | ||

| ALL OTHERS | $2,903.0 | $3,976.0 | $1,073.0 | 37.0% | ||

| TOTAL | $2,947.5 | $4,263.5 | $1,316.0 | 44.6% |

TEN BIGGEST PANDEMIC PROFITEERS (Percent/Amount wealth increased over past year)

- Bom Kim (670%/$7.7 billion): A U.S. citizen and founder of the e-commerce giant Coupang, the Amazon of South Korea. Kim’s fortune surged as high as $11 billion after the company’s IPO in early March.

- Dan Gilbert (642%/$41.7 billion): Owner of Quicken Loans, which capitalized on cloistered citizens tapping online financing. Lives in Michigan.

- Ernest Garcia II (567%/$13.6 billion): Biggest shareholder of Carvana, the online car sales and auto-financing giant. Arizona resident.

- Elon Musk ($559%/$137.5 billion): Musk is now the second wealthiest Americans—at nearly $138 billion—as his shares in Tesla, Space-X and other companies that he owns continue to climb. Lives in Texas.

- Brian Armstrong (550%/$5.5 billion): Chief executive of Coinbase, the largest cryptocurrency exchange in the country. California resident.

- Bobby Murphy (531%/$10.1 billion): Co-founder of Snapchat, with his Stanford fraternity brother, Evan Spiegel. California resident.

- Evan Spiegel (490%/$9.3 billion): Co-founder of Snapchat with his other billionaire super-gainer, Bobby Murphy. California resident.

- Jack Dorsey (396%/$10.3 billion): Co-founder and CEOs of both Twitter and Square, the small business payment app. Lives in California.

- Anthony Wood (331%/$5.3 billion): Founder of Roku, which enables online TV video streaming. California resident.

- Jeff Green (300%/$3 billion): Californian founder and chairman of The Trade Desk, a digital advertising firm.

OTHER NOTABLE BILLIONAIRE WEALTH GAINERS DURING THE PANDEMIC

- Eric Yuan, co-founder of video-conferencing technology Zoom, saw his wealth rise by $8.4 billion during the pandemic year, a gain of 153%. A year ago, Yuan had $5.5 billion which increased to $13.9 billion. Last year Zoom paid no federal income taxes on its $660 million in profits, which increased by more than 4,000%.

- The three owners of Airbnb saw their wealth accelerate thanks to their pandemic year IPO. Brian Chesky’s wealth increased from $4.1 billion to $14.6 billion, a gain of $10.5 billion, an increase of 256%. Nathan Blecharazyk and Joe Gebbia, with equal ownership stakes valued at $4.1 billion a year ago, each saw their wealth increase to $13.2 billion, for gains of $9.1 billion each, or 222%.

- Jim Koch, owner of Boston Beer Company and brewer of the Sam Adams brand, saw his wealth increase from $1.3 billion to $3.2 billion, a gain of $1.9 billion over the pandemic year, or 146%.

- Dan and Bubba Cathy, the owners of drive-through sensation Chick-Fil-A, saw their combined wealth of $6.8 billion rise to $16.6 billion, a gain of $9.8 billion over the pandemic year, or 144%.

- Harold Hamm, the politically connected oil and gas fracker, saw his wealth increase from $2.4 billion to $7.5 billion during the pandemic year, an increase of 5.1 billion, or 212.5%.

TABLE 3

| ONE-YEAR U.S. BILLIONAIRE WEALTH GROWTH BY INDUSTRYMarch 18, 2020 – March 18, 2021 | |||||

| Industry | Net Worth Mar. 18, 2020 ($ Billions) | Net Worth Mar. 18, 2021 ($ Billions) | 1 Year Wealth Growth ($ Billions) | 1 Year % Wealth Growth | Number of Billionaires Per Industry |

| Technology | $833 | $1,397 | $564 | 67.8% | 121 |

| Finance & Investments | $617 | $843 | $226 | 36.6% | 166 |

| Automotive | $54 | $227 | $172 | 316.9% | 17 |

| Fashion & Retail | $363 | $463 | $100 | 27.4% | 51 |

| Media & Entertainment | $191 | $249 | $58 | 30.6% | 36 |

| Food & Beverage | $218 | $271 | $54 | 24.6% | 63 |

| Diversified | $104 | $135 | $31 | 30.1% | 10 |

| Healthcare | $68 | $105 | $36 | 52.9% | 27 |

| Manufacturing | $62 | $90 | $28 | 45.6% | 26 |

| Energy | $84 | $107 | $23 | 26.8% | 31 |

| Service | $66 | $82 | $16 | 24.7% | 26 |

| Real Estate | $142 | $157 | $15 | 10.7% | 44 |

| Logistics | $16 | $22 | $6 | 37.9% | 6 |

| Sports | $74 | $79 | $5 | 6.3% | 23 |

| Construction & Engineering | $11 | $14 | $3 | 29.0% | 3 |

| Telecom | $8 | $11 | $3 | 37.2% | 3 |

| Gambling & Casinos | $37 | $13 | ($25) | -66.2% | 4 |

| TOTAL | $2,947.5 | $4,263.5 | $1,316.0 | 44.6% | 657 |

Source: Forbes data analyzed by Americans for Tax Fairness and Institute for Policy Studies, March 18, 2021

Source: Forbes data analyzed by Americans for Tax Fairness and Institute for Policy Studies, March 18, 2021

TABLE 4

| ONE-YEAR U.S. BILLIONAIRE WEALTH GROWTH BY STATEMarch 18, 2020 – March 18, 2021 | |||||

| State | Net Worth Mar. 18, 2020 ($ Billions) | Net Worth Mar. 18, 2021 ($ Billions) | 1 Year Wealth Growth ($ Billions) | 1 Year % Wealth Growth | Number of Billionaires |

| U.S. TOTAL | $2,947.5 | $4,263.5 | $1,316.0 | 44.6% | 657 |

| Arizona | $22.0 | $46.2 | $24.2 | 110.0% | 11 |

| Arkansas | $115.0 | $129.7 | $14.7 | 12.8% | 5 |

| California | $688.3 | $1,239.5 | $551.2 | 80.1% | 165 |

| Colorado | $31.0 | $43.1 | $12.1 | 39.0% | 10 |

| Connecticut | $54.2 | $58.6 | $4.4 | 8.1% | 11 |

| Florida | $183.2 | $228.4 | $45.2 | 24.7% | 59 |

| Georgia | $41.6 | $61.5 | $19.9 | 47.8% | 12 |

| Hawaii | $11.0 | $22.8 | $11.8 | 107.3% | 2 |

| Idaho | $3.5 | $3.4 | ($0.1) | -2.9% | 1 |

| Illinois | $52.5 | $70.5 | $18.0 | 34.3% | 17 |

| Indiana | $13.5 | $16.7 | $3.2 | 23.7% | 3 |

| Iowa | $3.8 | $5.4 | $1.6 | 42.1% | 1 |

| Kansas | $41.7 | $51.0 | $9.3 | 22.3% | 2 |

| Kentucky | $7.1 | $9.2 | $2.1 | 29.6% | 2 |

| Louisiana | $3.2 | $3.4 | $0.2 | 6.3% | 1 |

| Maine | $1.4 | $2.3 | $0.9 | 64.3% | 1 |

| Maryland | $25.0 | $33.8 | $8.8 | 35.2% | 10 |

| Massachusetts | $51.5 | $94.8 | $43.3 | 84.1% | 21 |

| Michigan | $29.1 | $76.9 | $47.8 | 164.3% | 7 |

| Minnesota | $4.9 | $7.0 | $2.1 | 42.9% | 4 |

| Mississippi | $2.8 | $2.8 | $0.0 | 0.0% | 2 |

| Missouri | $17.3 | $23.7 | $6.4 | 37.0% | 6 |

| Montana | $12.9 | $15.6 | $2.7 | 20.9% | 4 |

| Nebraska | $73.0 | $102.6 | $29.6 | 40.5% | 3 |

| Nevada | $56.5 | $38.3 | ($18.2) | -32.2% | 10 |

| New Jersey | $17.6 | $25.0 | $7.4 | 42.0% | 7 |

| New York | $480.4 | $596.8 | $116.4 | 24.2% | 114 |

| North Carolina | $13.7 | $14.4 | $0.7 | 5.1% | 3 |

| Ohio | $12.8 | $15.4 | $2.6 | 20.3% | 6 |

| Oklahoma | $25.8 | $38.0 | $12.2 | 47.3% | 6 |

| Oregon | $31.2 | $55.7 | $24.5 | 78.5% | 2 |

| Pennsylvania | $27.2 | $39.1 | $11.9 | 43.8% | 13 |

| Rhode Island | $1.8 | $2.1 | $0.3 | 16.7% | 1 |

| South Carolina | $1.3 | $1.9 | $0.6 | 46.2% | 1 |

| South Dakota | $2.0 | $2.8 | $0.8 | 40.0% | 1 |

| Tennessee | $24.7 | $41.5 | $16.8 | 68.0% | 11 |

| Texas | $238.9 | $299.0 | $60.1 | 25.2% | 60 |

| State | Net Worth Mar. 18, 2020 ($ Billions) | Net Worth Mar. 18, 2021 ($ Billions) | 1 Year Wealth Growth ($ Billions) | 1 Year % Wealth Growth | Number of Billionaires |

| Utah | $5.2 | $6.2 | $1.0 | 19.2% | 4 |

| Virginia | $41.2 | $55.7 | $14.5 | 35.2% | 7 |

| Washington | $321.4 | $456.0 | $134.6 | 41.9% | 14 |

| West Virginia | $1.2 | $0.0 | ($1.0) | -100.0% | 0 |

| Wisconsin | $39.4 | $51.9 | $12.5 | 31.7% | 8 |

| Wyoming | $55.9 | $60.2 | $4.3 | 7.7% | 5 |

| NO STATE TOTAL | $59.8 | $114.6 | $54.8 | 91.6% | 24 |

Source: Forbes data analyzed by Americans for Tax Fairness and Institute for Policy Studies, March 18, 2021