The Apple Card, unveiled this past March, promises consumers cash rewards and no fees. Sync the card with your device to make payments via Apple Pay, accepted by 70 percent of retailers in the U.S. For places that don’t accept Apple Pay, you can use the physical card.

The company is banking on consumer loyalty, hoping swarms of tech-lovers will flock to a similarly branded credit card. Is it better than other options out there? Read the Apple Card review below to find out.

What You Need to Know

It is free to apply for this card, and there is no annual fee to keep it. The interest rate, which ranges from around 13-24 percent, depends entirely on your credit score. Mastercard and Goldman Sachs, who have partnered with Apple on the venture, hope to gain an audience they wouldn’t typically attract.

If you decide to apply for the Apple Card, the process is no different than any other credit card. You’ll need to supply personal information like your name, address, Social Security number, yearly income, and more.

You will receive a decision instantly, along with your calculated interest rate. You can either agree to the terms or look for a better option. According to Apple, applying for the credit card does not affect your credit score unless you accept. Once approved, you can start using your digital card in Apple Wallet right away.

Benefits of the Apple Card

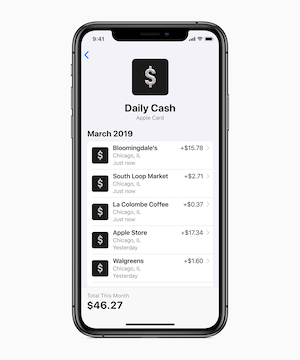

You can earn cash back on all your Apple Card purchases. You receive three percent back on Apple services and products, and two percent from all purchases made with Apple Pay. All other transactions, including those made with the physical card, get one percent cash back.

The earning potential for rewards is not capped at a maximum amount. Cash is added to your account daily, instead of weekly or monthly. When you want to redeem your rewards, you have the option to purchase with Apple Pay, send money to a friend, pay a credit card bill, or transfer to your bank account.

Apple touts quality assurance for consumers who are hesitant to sign up for it. They also prioritize security – each purchase requires approval through Touch ID or Face ID. If lost or stolen, you can freeze your card immediately and request a replacement.

Pitfalls of the Apple Card

The rewards system, while enticing at first, diminishes in value for those who don’t regularly use Apple products, services, and payment methods. For consumers who typically use their physical cards to make in-store and online purchases, one percent cash back does not compare to other available offers.

Additionally, most cards offer a significant sign-on bonus to those who spend a certain amount within the first few months. Apple is not offering any bonus to new customers, hoping brand devotees will register regardless.

The card also advertises no penalties or fees for late payments. However, it still assesses additional interest, which many see as a penalty in disguise.

Is the Apple Card Worth Getting?

Is the Apple Card worth getting? It depends. If you have Apple products, like an iPhone, smartwatch or MacBook, this card could be an ideal way to save. You can also sync it to Apple Pay for convenient payments through your phone.

If you care more about maximizing rewards than brand names, this card may not be for you. Unless you’re using Apple Pay or purchasing an Apple product, you will only earn one percent cash back. There are a lot of comparable options that garner two percent back on all spending, without the need to use a new payment system.