Cryptocurrency has undergone some significant growing pains in its rise to mainstream recognition. As crypto and its surrounding technologies have become more popular, rising regulations and dramatic market shifts have made prices repeatedly surge and fall beyond many’s expectations. Amid these changes, keeping in tune with developing crypto mining trends is becoming increasingly important.

The crypto market moves quickly and will likely see drastic changes as its mainstream adoption grows. Here are five crypto mining trends that will have the greatest impact in 2023 to help you navigate these shifts.

1. Government Regulations

As cryptocurrency grows among consumers and businesses, it naturally attracts more attention from government bodies, too. Consequently, increasing regulation over crypto mining will significantly impact the market in 2023.

In September 2022, the White House released the first comprehensive framework for digital asset development in the U.S. This framework included goals to strengthen enforcement actions from bodies like the FTC and SEC to crack down on potentially risky, unfair or deceptive crypto practices. New legislation outlining legal mining operations and considerations will almost certainly follow.

Other legislative changes, like funding U.S.-based chip manufacturers, may affect the prices and availability of crypto mining machines, too. Individuals and companies wanting to capitalize on mining should pay attention to these laws to ensure they remain in goo d legal standing.

2. Privatization and Mergers

These rising regulations, on top of 2022’s difficult year for public mining companies, will influence other crypto mining trends. One of the most notable of these is a shift towards privatization and mergers among mining businesses.

Public bitcoin miners lost a combined $15 billion in 2022, with all public mining stocks falling at least 80% year-over-year. In light of these dramatic losses, many of these organizations will likely merge to spread out the damage and combine their resources to aid an easier recovery. Others will go private, forsaking potential gains on the stock market in favor of fewer regulatory complications.

This shift will leave investors with fewer options, but it could help the market recover faster. It may also make resources like crypto mining machines more affordable as demand drops, opening opportunities for hopeful miners looking to start or expand their operations.

3. Sustainable Mining

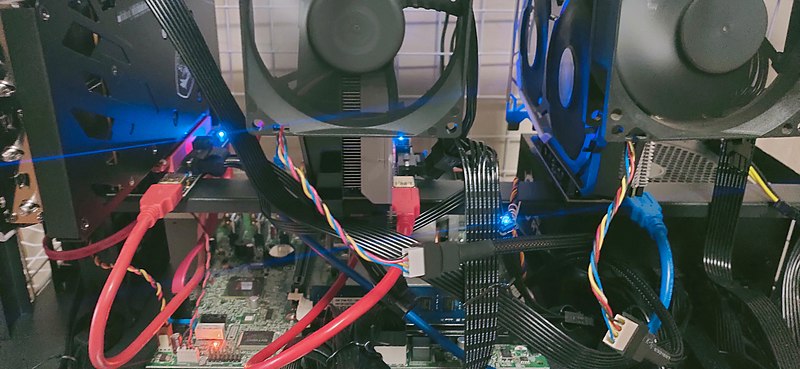

Like virtually every other sector, crypto mining will also respond to the growing demand for environmental sustainability. Conventional mining is energy-intensive, requiring switchgear and transformers up to 1.5 gigawatts, and because most electricity comes from fossil fuels, this produces considerable emissions. As environmental concerns rise, mining practices must adapt to lower this footprint.

Proof-of-stake cryptocurrencies may overtake more conventional proof-of-work alternatives for their lower energy consumption. Ethereum switched to a proof-of-stake model in late 2022, reportedly cutting its power usage by 99.9%, and others will likely follow.

Similarly, sustainable mining methods like using renewable energy to power and cool mining rigs will become more popular. Mining organizations that employ these more environmentally responsible technologies could see more success than those that don’t in tomorrow’s market.

4. Cloud Mining

Some cloud mining trends in 2023 will alter how people participate in mining. One of the most impactful of these is cloud mining, where you pay for access to remote mining farms instead of running on-premise hardware.

While graphics card (GPU) prices have fallen over the past year, building large-scale crypto mining machines is still expensive. It can also lead to considerable energy spending, depending on how you power it and what kind of crypto you mine. Cloud mining offers a more accessible and often affordable alternative.

For organizations with on-prem hardware, cloud mining presents an opportunity to further monetize their operations. This business model could help offset losses from last year’s crypto winter.

5. International Growth

The cryptocurrency market in the U.S. may have had a challenging 2022, but that hasn’t been the case everywhere in the globe. Crypto is still booming in some countries, so most of 2023’s mining growth may come from outside the U.S.

Latin America is one of the fastest-growing regions, containing four of the top crypto-adopting countries in 2022. Much of this growth comes from countries like Brazil and Columbia implementing national digital currencies. Similarly, some Argentine cities have started accepting crypto tax payments to fight inflation. This growing government interest in crypto creates a more positive environment for blossoming crypto mining companies.

Southeast Asia is another region to watch. The area is now home to more than 600 crypto and blockchain companies, which saw $1 billion in venture capital funding in 2022 alone.

Is Crypto Mining Worth It in 2023?

Given the issues the crypto market has faced in recent years, some prospective miners may question if crypto mining is worth it in 2023. The answer to that question depends on your goals, resources and how you approach the practice.

Many crypto mining prices have fallen, making mining rewards less profitable. However, the cost of crypto mining machines has also dropped, and trends like cloud mining offer lower-cost approaches. After enough time, crypto mining can be significantly less expensive than buying crypto outright, so it can still be a more profitable way to capitalize on cryptocurrency.

Rising regulations and competition raise the barrier to entry, so crypto mining may only be worth it to organizations with enough resources to manage the administrative burden and upfront costs. It’s also best to approach it with tempered expectations, anticipating slow growth rather than the opportunity to make quick returns.

Stay on Top of Developing Crypto Mining Trends

Crypto mining is still worth it in 2023 if you can anticipate and react to changing crypto mining trends. Once you understand where the market is going and why it fluctuates, you can make the most informed decisions about how to capitalize on it. You can then safely and profitably tap into cryptocurrency.