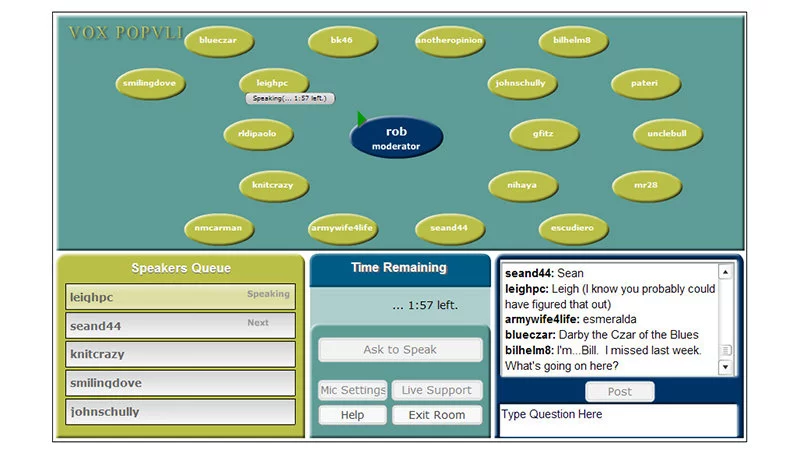

When Bill and Vicki Sarris set out to develop Vox Populi, the revolutionary video chat application that hosted Stanford University’s now-iconic “Dialogues in Democracy” in 2007, they couldn’t have imagined where it would lead them over the next 15 years. Designed to offer a circular meeting space in which attendees could interact with each other via text and audio, the technology would later be adopted by then-President Obama’s team and serve as the foundation of what would be their life’s work: Linqto.

Founded in 2010, Linqto has now facilitated over $300M in total investments for almost 500K investors all over the world. A far cry from the technology that originally facilitated face-to-face agent banking between banks and customers, Linqto’s self-directed investment platform is now democratizing the private markets, a disruptive move that millions of global accredited investors are poised to benefit from.

Linqto already offers its 420K registered users the opportunity to buy or sell in world-class companies long before they go public, significantly increasing the potential returns in the long term. The list of companies available to Linqto users includes 48 names as diverse as Cerebras, Discord, Acorns, and Dapper Labs, with new companies regularly added after an extensive risk assessment.

While the provided services of Linqto might not look like much to those unfamiliar with pre-IPO investment, experienced investors have been quick to recognize them as game-changing. Traditionally, investors looking to acquire pre-IPO equity need to jump through multiple hoops to even have the opportunity of being considered as a potential investor, including minimum investments ranging between $100K and $25M. Linqto investors, on the other hand, are only required to invest a minimum of $2,500 to start their pre-IPO investing journey.

In addition to the significantly lower minimum investment, Linqto offers benefits like no brokerage, management, or administrative fees, no waiting period, self-service, and advanced monitoring tools. Once an investor is approved after registering, they will gain access to FDIC-protected brokerage-style cash accounts and a digital asset wallet powered by Uphold, adding a layer of convenience by combining traditional finance, fintech, and DeFi.

An Alternative Trading System (ATS) was also introduced in July of 2023 to facilitate the secondary trading of equity securities in real time. The expanded capabilities that followed the approval of the necessary licenses by FINRA make it possible for Linqto users to buy and sell their equity with same-day settlements. As those investing in private markets would traditionally be required to wait for an IPO/acquisition or private offering to sell, Linqto’s approach provides true liquidity while making pre-IPO investments more similar to other forms of investment.

While Linqto’s unique approach to private markets is certainly a game changer, such success doesn’t happen in a vacuum. The increasing demand for innovative yet accessible investment instruments has set the stage for Linqto’s meteoric growth, an opportunity the company quickly seized. With all eyes on it, Linqto is ready to continue leading the charge to democratize private markets and, hopefully, set a higher standard for one of the most obscure spaces in the world of financial investments.