Tesla Inc. and SpaceX Corp. CEO Elon Musk has never been one to shy away from controversy. Many of his tweets have influenced the stock market in one way or another, sometimes to the detriment of his own companies.

While his tweets and bold financial moves have landed him in hot water more than once, there must be some serious calculation involved in every wayward tweet. He has ultimately come out on top, amassing a personal fortune of $289 billion – $100 billion more than Amazon inc. CEO Jeff Bezos.

Musk Acquires 9.2% Stake in Twitter

This week, Musk is in the headlines again after using a (relatively) small portion of his enormous wealth to secure a 9.2 stake in Twitter Inc., Musk’s preferred platform to communicate with the world. The stock purchase, worth $2.9 Billion, saw Musk become the social media company’s biggest outside shareholder.

After news of Musk’s purchase broke Monday through an SEC filing, shares of Twitter rose 26% in pre-market trading, adding $8 billion to its $31.5 billion market value.

Musk vs. SEC

The Tesla CEO originally claimed to be a passive shareholder in Twitter, meaning he would not seek to change or influence the company directly. The document that Musk registered with the Securities Exchange Commission (SEC) – a 13G form – indicates that he planned to be a passive investor and that he did not intend to take on a larger role with the company. Those forms require the shareholder to include a certification saying they didn’t acquire the shares in order to influence or control the company. Musk did not include that statement on his form; instead, he wrote “not applicable.”

Musk then amended his original filing to a form 13D, which is often used by activist investors. Because the new filing required more disclosure, it was found Musk had been accumulating Twitter stock since Jan. 31 and purchased shares in every available trading session through April 1. The SEC requires disclosure within 10 days of acquiring 5% or more of a company’s common share.

Musk appears to have waited 21 days after March 14 to file the form. A substantial financial penalty could be incurred for the lack of disclosure.

Criticism of Twitter’s Policies

The announcement of the new filing became public Tuesday, the same day Musk was named to Twitter’s board. It became apparent almost immediately that he planned to shake up the company, polling users on whether an edit tool should be implemented on the platform.

A self-proclaimed “free speech absolutist,” Musk has criticized censorship on Twitter for years, recently going so far as to consider creating his own platform.

Support from Twitter Elites

While Twitter CEO Paraf Agrawal is aware of Musk’s stance on the company’s policies, he welcomed the entrepreneur and the perspective he will bring to the boardroom.

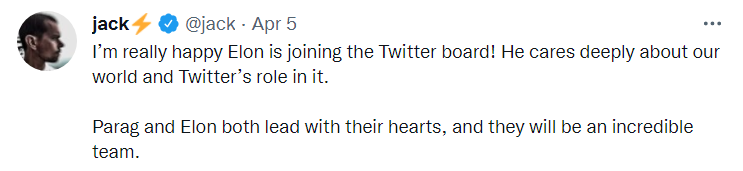

Twitter founder and former CEO Jack Dorsey also endorsed Musk and his new role.

Limited Power

However, his position as a class II director comes with some caveats.

“For so long as Mr. Musk is serving on the Board and for 90 days thereafter, Mr. Musk will not, either alone or as a member of a group, become the beneficial owner of more than 14.9% of the Company’s common stock outstanding at such time, including for these purposes economic exposure through derivative securities, swaps, or hedging transactions,” according to a Twitter filing with the SEC.